Business Community

Gig Harbor Real Estate | Prices slip slightly as market turns neutral

For the first time in more than two years, the median sale price of a single-family home in the greater Gig Harbor area—spanning from the Purdy Bridge to the Narrows Bridge and including Fox Island—fell in October. The decline was small, just $5,000, bringing the median to $945,000, according to the Northwest MLS.

The last monthly price dip occurred in September 2023, when the median fell to $827,492. Even with October’s softening, prices remain 5 percent higher than one year ago, well above the 1.4 percent national gain reported by Redfin. A one-month decline in the fall is historically normal and not a trend unless it continues for several months.

Sales activity this fall is tracking in line with 2024 levels—not meaningfully higher or lower—but still well below the pace seen during the pandemic surge. Listings have increased from last year, but compared with pre-COVID conditions, greater Gig Harbor remains significantly undersupplied.

Based on a five-year pre-COVID average, the area typically carried about 272 active listings at this time of year. October 2025 produced 167 listings, roughly 105 fewer homes than the historical norm. Pending sales in the five years before COVID averaged about 80 per month, while October saw 49.

Mortgage rates also remain elevated relative to earlier in the decade, but are meaningfully down from last year. The average 30-year fixed ranged between 6.17 and 6.37 percent in October, more than a half point lower than this same time last year, according to Mortgage News Daily.

Inventory remains below the four-to-six-month benchmark that defines a balanced market. On paper, the numbers still tilt toward sellers, but buyer behavior increasingly resembles a neutral one. Buyers are taking their time, negotiating harder, and asking for seller concessions such as closing cost credits and rate buy-downs.

The Eagle Crest Estate, a 7-acre property with nearly 300 feet of Gig Harbor waterfront, features 5 bedrooms, 6 bathrooms, an elevator, and a full multi-generational suite. Listed at $3.95 million by Alison Paoli of PropertiesNW of Gig Harbor.

The rise and impact of new construction

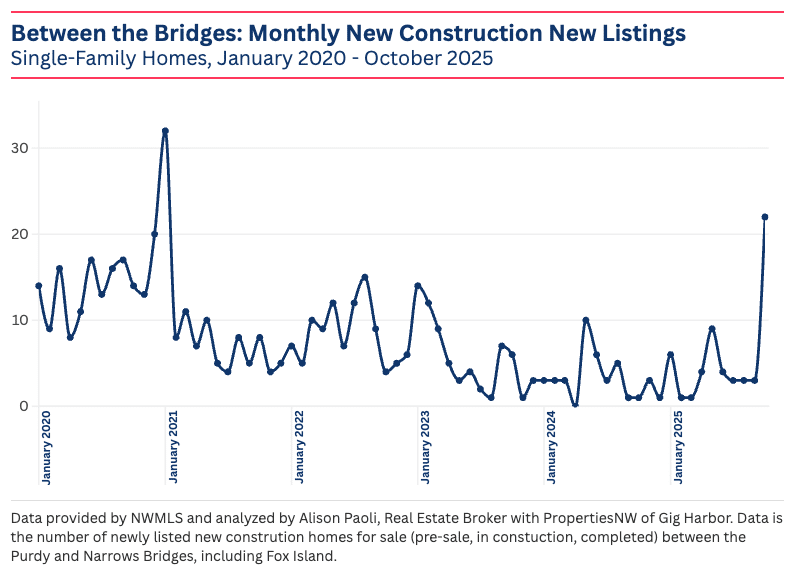

A wave of new-construction listings hit the market in October, reaching their highest monthly volume since 2021. Most are priced between $930,000 and $1.5 million, with the bulk clustered near the top end of that range. Nearly all are under construction or pre-construction and won’t be move-in ready for up to a year or more. Much of this activity is concentrated in Gig Harbor’s north end, including Rush Residential’s Burnham Heights, J.K. Monarch’s Firdrona Crest, MainVue’s The Reserve at Gig Harbor, HNK Construction’s The Ranch at Crescent, and several individual custom builds.

This surge is materially influencing market-wide statistics, specifically inventory levels and supply and demand (months of inventory). Total homes for sale rose slightly from 165 in September to 167 in October — a period when inventory typically falls. But resale listings dropped from 152 to 137 during the same period, while new-construction listings more than doubled, from 13 to 30.

Months of supply also split by new construction. Resale homes sit at 2.7 months of inventory, down seasonally from the current year peak in July of 3.4 months. New construction rose from 6 months in September to 14.4 months in October. Inventory by price tier further highlights the difference: 2.4 months under $900,000 (no new construction), 4.8 months between $900,000 and $1.25 million (where most new construction sits), and 2.0 months above $1.5 million.

Sellers with homes in the new-construction price range should expect more competition and longer market times, and with it, softer home price growth. Accurate pricing and strong preparation are essential. Sellers outside the new-build range may still see metrics that favor them, but buyer behavior does not. Buyers are patient, selective, and increasingly request concessions. Presentation, pricing, and condition matter.

For buyers, more inventory — especially new construction — means more choice and more negotiating power than they’ve had in several years. Builders frequently offer unadvertised incentives, including closing cost credits, upgrades, and mortgage rate buy-downs, and these are often negotiable. Working with a buyer’s agent remains important to uncover and secure those concessions.