Community Government

Opinion mixed on Pierce County public safety levy proposal

In-person public opinion was mixed on a public safety levy proposal the Pierce County Council introduced in a special meeting on Feb. 9. Detractors included self-described supporters of law enforcement in general and the Pierce County Sheriff’s Office specifically.

If passed, the levy would create a 0.1% sales tax — one cent on every $10 spent — to increase funding for public safety, including hiring in the Pierce County Sheriff’s Office. Hiring in the sheriff’s department has been an ongoing cause of concern in the county, particularly in the Gig Harbor area of unincorporated Pierce County.

The levy needs the support of at least five of the seven county council members to pass.

Last spring, Gov. Bob Ferguson signed into law House Bill 2015, which allows local governments to enact this sales tax and to apply for grants from a $100 million public safety fund. The Washington State Criminal Justice Training Commission administers the grant program.

Last fall, the county created a Justice and Public Safety Funding Group to study ways to increase funding for public safety. The group included representatives from the offices of the county clerk, sheriff, prosecuting attorney, executive and finance.

That group submitted the levy proposal to the county council in January.

Funding needs

Pierce County Senior Counsel John Lane explained that the county would use about 80% of the revenue collected through the sales tax to maintain current service and staffing levels. The other 20% would allow “flexibility in the future.”

“We have … ongoing and escalating costs, and we’re going to need this fund now and into the future to continue to provide the level of service that the residents of Pierce County are entitled to,” Lane said.

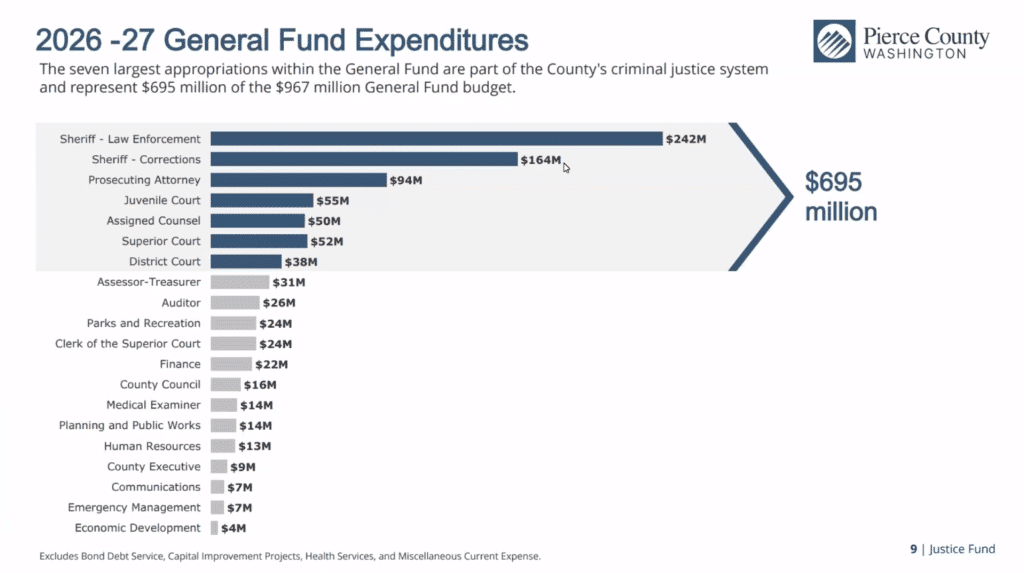

The county spends more than three-quarters of its general fund on public safety. The council approved $730 million in public safety spending in its most recent budget. The lion’s share of that goes to the Pierce County Sheriff’s Office.

Julie Demuth, director of the county finance department, explained that the county general fund also supports several other legally mandated, essential services. Those include elections, code enforcement and medical examiner services.

Expenditures from the Pierce County General Fund.

Any cuts to these areas of operation would make it difficult for the county to provide basic government functions. Such cuts could put the county in hot water, legally speaking.

“As a result, there’s very limited flexibility in the general fund to absorb rising costs. We are projecting a $34 million ongoing structural deficit by 2028, an amount that cannot be addressed through incremental reductions alone,” Demuth said. “To put that into perspective, a $34 million gap is larger than the entire general fund budgets of 13 of our county departments. An across-the-board cut could result in a $5.5 million reduction to law enforcement, resulting in the loss of as many as 37 law enforcement deputies. Even eliminating all of our parks and recreation services would still not be enough to close the gap.”

Potential legal liability

Addressing the deficit through cuts alone, she continued, would require eliminating some departments entirely and making deep cuts to others. That includes the county’s public safety agencies.

“Because public safety and the courts dominate our general fund spending, large reductions inevitably fall back on law enforcement, corrections and our courts,” Demuth continued. “Without new revenue, maintaining our current service levels we have today becomes increasingly unrealistic.”

The county also faces serious legal liability without appropriate funding, particularly in its criminal justice services.

“These are pressures that are mandatory, they’re structural in nature, and they are largely outside of local control,” Demuth explained.

For instance, she said, the state mandates that the county keep up with a certain amount of public defense casework. Remaining compliant requires a “substantial increase in staffing, driving an estimated $32 million in added ongoing costs and nearly 50 new positions through 2031. Over the next six years, the county must add these positions to remain in compliance with state law.”

She also said that the county faces “significant exposure from tort claims, particularly related to our detention facilities. This represents hundreds of millions of dollars in potential liability and substantial financial risk.”

Support from sheriff

Even Pierce County Sheriff Keith Swank — who noted that he usually opposes taxes and that he’s “had my difficulty with … the council and with the executive” — supports the tax. Swank highlighted the legal liabilities the department faces without more funding.

He was part of the group that brought forward the levy proposal, and the sheriff’s department has applied to the grant program created by the legislation that allows the public safety tax.

“It’s very important that we have body-worn cameras in the jail. And I know it’s an expense for people, and they look at it and say, ‘Oh, a million dollars,’” Swank said. “Let me just say this: Last year in our jail, three people died. I’m not saying that we had any culpability there at all, but we didn’t have a camera to show what we did to save their lives or try to save their lives. That causes civil litigation. A million dollars is nothing compared to what might happen if somebody says we did something wrong and we don’t have proof to show that we didn’t do anything wrong.”

He also said that more funding means better hiring incentives for the sheriff’s department. Several members of the public, council members, and the sheriff’s department have said the department needs increased incentives to hire and retain deputies.

“And on the corrections side, we have agencies around here that are offering sign-on bonuses for $50,000,” Swank said. “It makes it very hard to compete with those agencies that do that.”

Mixed opinions

Public sentiment on the levy was mixed, though more people who spoke at the meeting opposed the measure. However, because of time constraints, the council did not have time to take comments from everyone who signed up to speak. The council will continue the meeting at 9 a.m. Wednesday, Feb. 18, to take further comment.

Safe Streets’ Community Mobilization Manager Connor Schultz said that he supports the measure, even though he is also “very sensitive” about his income, just like others in the room speaking against the measure. He said that, when he speaks with Pierce County residents, “the perceived lack of law enforcement and other emergency services is the number one [thing] people talk to me about.”

“That said, I do hope that there’s recognition that while money is an important aspect in keeping things running, it is not the only thing that is necessary in keeping things going,” Schultz noted. “There were a few items on the information that we’ve been provided that do seem a little, a little unnecessary in my viewpoint.”

Shannon Shea, the executive director of Tacoma Community Boat Builders, said that she and the organization support the proposal. Tacoma Community Boat Builders provides hands-on skills for underserved, at-risk youth.

Underfunded youth prevention programs only means more young people engaging in crime, she said, which significantly impacts the rest of their lives. It’s also more costly for the justice system — and, therefore, taxpayers.

“Youth who penetrate deeper into the juvenile justice system cost the county significantly more in detention, court processing and long-term supervision than youth served through early intervention and positive youth development,” she said. “The most effective public safety strategy is stopping young people from entering the system in the first place. Without a dedicated funding source, prevention programs are often the first to be caught in budget shortfalls, which we have seen in this year.”

Opponents

Other Pierce County residents spoke against the proposal.

Austin, who did not give her last name and identified herself as a new mother, said she took time off work to let the council know that the increases in the budget the council had just passed have hurt her and her family. She and her husband both work full-time jobs, she said, but they still struggle to afford the basics. Following the budget passage, she said, she and her husband accepted that they would need to find a way to “make it work.”

“We cut back, we shifted things around, tightened our household budget the way that families do when times get harder,” Austin said. “But now, after the [county] budget has already been balanced, we are being told that there may be another increase through a sales tax. It may just seem like pennies to you, but those pennies add up. They have to come from somewhere. For our family, every extra $15 in taxes equals one more hour of work that we put in every week, just to keep up.”

Ann Jolie of Gig Harbor said she opposes the tax because it wouldn’t substantially add more deputies to the sheriff’s department.

“This tax does not guarantee a single new officer, yet it allows hiring 19 full-time software engineers,” Jolie said. “It also allows maintaining existing programs, which can mean millions continue to go to programs that are not core essential public safety [services].”

The framework, she said, also means that the county may have to shift its funding priorities “based on what the state defines as important, not what our community wants.”