Business Community

Gig Harbor Real Estate | Home prices climb despite jump in inventory

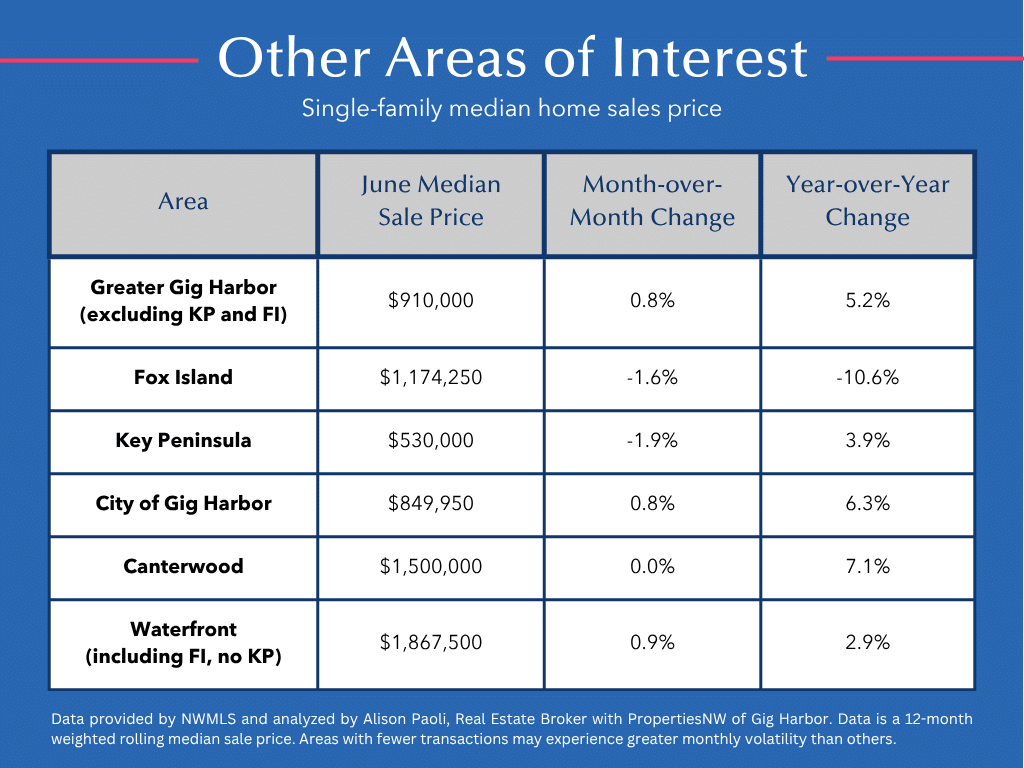

Home prices in the greater Gig Harbor area hit yet another record high in June, with the median sale price for a single-family home climbing to $935,000 — up 5.6% from a year ago and more than $100,000 above the recent low in September 2023 — even as inventory surged and mortgage rates remained elevated compared to earlier in the decade.

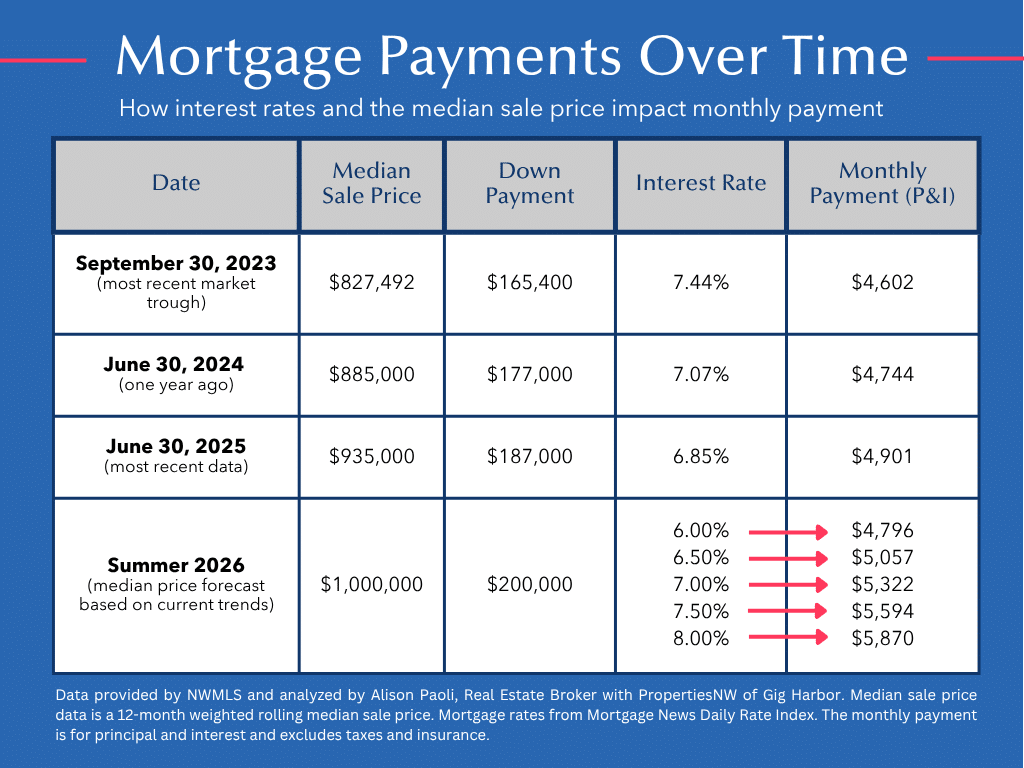

That September low came after a sharp rise in interest rates briefly pushed the median price down to $827,492. Since then, prices have steadily recovered and exceeded their previous peak — raising monthly housing costs for buyers despite a meaningful decline in mortgage rates.

Mortgage payments

Assuming a 20% down payment and a 30-year fixed mortgage, the monthly principal and interest payment on the September 2023 median-priced home of $827,492 at an interest rate of 7.44% would have been about $4,602. Today, even with a slightly lower average rate of 6.85%, the higher June 2025 median price of $935,000 results in a monthly payment of $4,901 — an increase driven entirely by rising home values.

As a local real estate broker, I periodically hear from buyers who say they’re waiting for rates to drop before jumping in. For buyers waiting for lower mortgage rates, it can feel like running down an escalator that’s moving up: as prices rise, any savings from a lower rate can be quickly offset — or even erased — by the increasing cost of the home itself.

A Ray Nash-area waterfront home with western-facing views is listed for $1,345,000 by Linda Watermeyer of PropertiesNW of Gig Harbor.

More homes available

What stands out is that price growth has continued even as inventory has increased significantly. At the end of June, 196 homes were listed for sale across the greater Gig Harbor area — which spans from the Purdy Bridge to the Narrows Bridge and includes Fox Island — up nearly 50% from the 132 homes on the market at the same time last year.

Still, inventory remains below pre-pandemic levels — a benchmark often used by economists as the last “normal” market. In June 2019, there were 245 active listings, about 20% more than in June 2025. Yet the number of pending sales this June was only 12.5% lower than in June 2019, suggesting buyer demand remains relatively strong.

The months of supply — a key measure of market balance — stood at 3.5 in June 2025, pretty similar to the 3.2 months reported in June 2019 (4-6 months is typically considered a neutral market, one that does not favor buyers or sellers).

While overall inventory remains higher than last year, the pace of new listings is beginning to slow. New listings dropped from 131 in May to 110 in June, and this seasonal decline is expected to continue. For buyers, that means fewer choices, but also the potential for less competition as the school year approaches. Families hoping to move before September typically need to be under contract by early August to allow time for closing and relocation.

Even so, competition remains strong for well-presented homes. Properties that are move-in ready, well-located and priced appropriately continue to draw multiple offers. In fact, 22% of all homes in Gig Harbor that went pending in the first half of July received multiple offers, underscoring that demand is still strong — especially for homes that check all the boxes.

Million median?

Looking ahead, if the average annual appreciation rate experienced over the past year — about 6.74% — persists into next year, the median sale price in Gig Harbor could reach $1 million by next summer.

At today’s average mortgage rate of 6.85%, a $1 million home with 20% down would result in a monthly principal and interest payment of approximately $5,240 — about $339 more per month than the current payment on June 2025’s median price, and about $638 more than what it would’ve been in September 2023.

For buyers weighing the decision to wait, it may be worth considering how both rising prices and stable interest rates could affect long-term affordability. And of course, while the data doesn’t support it happening imminently, there is always a possibility that prices do go down in a meaningful way.

Have a question about the data in this article, your home, or how the current real estate market impacts you? Connect with me at [email protected]