Community Government

Huge property value increases don’t portend corresponding tax hikes

Gig Harbor residents recently received green cards in the mail showing unprecedented jumps in property values. But don’t be alarmed. They won’t translate proportionally to higher property taxes.

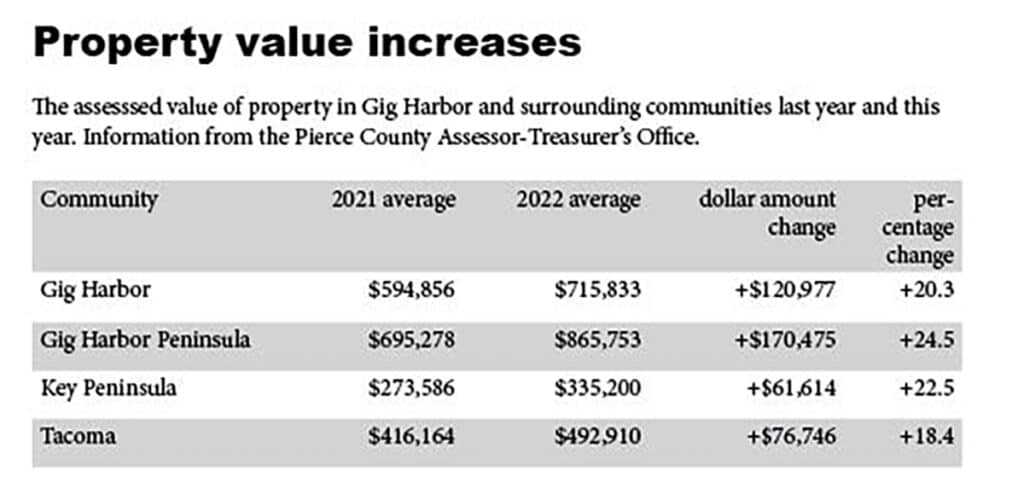

Property values skyrocketed last year, particularly here. Across Pierce County, values increased an average of more than 19 percent — $80,000 per property, according to Assessor-Treasurer Mike Lonergan.

Gig Harbor Peninsula properties, including those within the city limits, spiked a county-high 24.5 percent. The average rose $170,475 — from $695,278 to $865,763 — in a single year.

To repeat, the average Gig Harbor-area home is now worth $865,763.

Properties within the city soared 20.3 percent, from $594,856 to $715,833. On the Key Peninsula, values surged 22.5 percent, from $273,586 to $335,200.

PenMet Parks is one of several taxing districts that receive property tax dollars. Ed Friedrich / Gig Harbor Now

Unprecedented property value growth

“Oh yeah, people just get in a real panic,” Lonergan said of relating property values to tax statements, which won’t be mailed until February. “For us, it’s a high number. The average (countywide) was 16 percent last year, which is big, and 9 percent the previous year.”

Lonergan hasn’t seen anything like this since he took office in 2013.

“Every year since, values have gone up, but not by this percentage,” he said. “We’ve had single-digit increases basically the last nine years (before last year).”

The assessor’s office each year must appraise all the county’s 325,000 taxable residential and business properties at 100 percent of their true and fair market value. It compares them to similar properties that have recently sold, adjusting for differences in age, condition, area and amenities, such as waterfront or view.

Districts restricted to 1 percent increase

Despite the large jumps in property values, state law limits taxing districts to collecting no more than 1 percent more in regular property taxes than they did the previous year. An additional amount is added for taxes from new construction, which amounts to about 1.5 percent more.

Excess levies approved by voters, such as school or fire bonds, are not included in the limitation. When the McCleary court decision forced schools to fully fund basic education, the state added levies that weren’t included in the 1 percent cap.

“Those are things that were raising taxes by several percentages a year, a new levy passing, a bond issue or a levy lid lift or the Legislature unilaterally raising the school levy,” Lonergan said. “Those are much more cause-and-effect things than the values.

Gig Harbor Fire & Medic One is funded by property taxes and has placed a bond on the August primary election ballot for capital improvements. Photo courtesy of Gig Harbor Fire & Medic One

How it’s calculated

“Your property tax in 2023 will be the new 2022 value multiplied by the combined tax rates of your school district, city, fire district and so forth, added to the statewide school levy that everyone pays. So a lot depends on public votes in your local districts, such as levy lid lifts and bond issues.”

For example, Gig Harbor Fire & Rescue One has placed a $60 million bond on the August primary election ballot to replace Station 51 on Kimball Drive, improve stations 53 (Fox Island), 57 (Crescent Valley), 58 (Swede Hill) and 59 (Artondale) and build a live-fire training facility. The bond would last for 20 years and cost the owner of that average $865,753 home about $206 per year (23.8 cents per $1,000 of assessed property value).

Property owners continue to pay for a $198.5 million capital facilities bond Peninsula School District passed in February 2019 that was used to build two new elementary schools and replace two others. The cost to taxpayers is 79 cents per $1,000 of value, or about $684 per year on an $865,753 home.

Where the taxes go

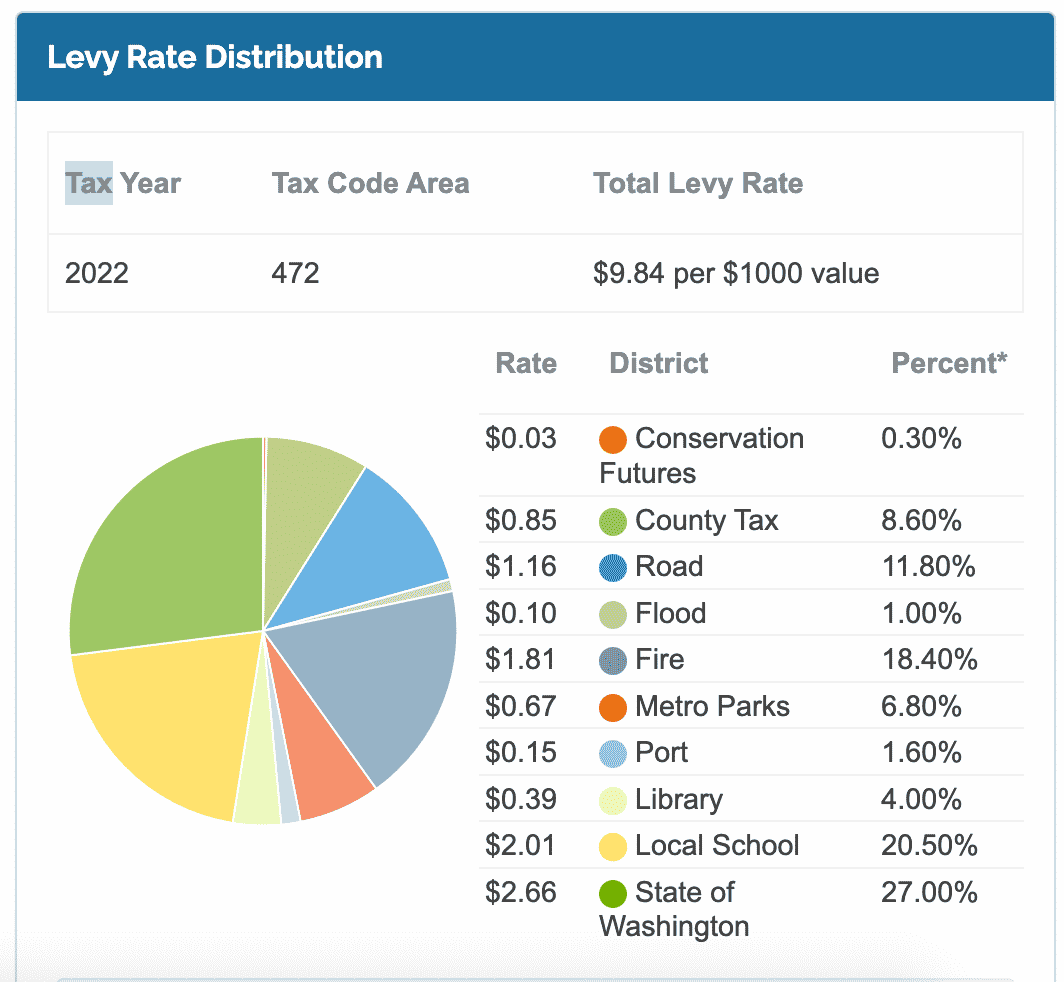

Last year the total levy rate for unincorporated Gig Harbor was $9.84 per $1,000 of value. Twenty-seven percent went to the state, including for education, and 20.5 percent for local schools, comprising nearly half the total.

Other taxing districts included the fire department (18.4 percent), county roads (11.8 percent), county administration (8.6 percent), PenMet Parks (6.8 percent), Pierce County Library System (4 percent), Port of Tacoma (1.6 percent), flood (1 percent) and conservation futures (0.3 percent). One-fourth of the total was approved by voters and thus wasn’t included in the 101 percent state limit above the previous year.

Those within Gig Harbor also pay city taxes. They don’t pay for county roads or the parks district, to which they don’t belong.

Property value and property tax

So property values and property taxes are not directly connected. Values are just one part of the equation.

If everyone’s value increases about the same amount, their piece of the tax pie remains about the same. Because values are so high this year, the tax rate will have to be reduced to remain under the 1 percent limit.

“The peninsula has the lowest rate in the county, but it will go even lower as value goes up because of this lid,” Lonergan said. “Value times rate can only be 1 percent more than collected before. Other than that, what is being increased is by a vote of the people.”

You can appeal the valuation

Any property owner who believes the assessor-treasurer’s office has overvalued their property can appeal to the Pierce County Board of Equalization, providing evidence that comparable properties have sold recently at a lower amount.

“Our message is anybody who believes they could not sell their property for what I have it valued should appeal,” Lonergan said. “It’s free, and they’ve got 60 days (until Aug. 23). The fact is that we’re not perfect, but most people who look into it will see, indeed, similar homes are selling for similar prices.”

Out of 325,000 properties, 1,000 to 2,000 typically will appeal.

“It may be higher this year because people won’t believe their house has increased in value by 20 percent,” Lonergan said.

Once every six years, a county appraiser is required by state law to inspect every parcel. They confirm records, note any changes in condition of buildings and views, and take a new exterior photo. Major improvements will bump up the value.

Because voters could pass levies and bonds before the end of the year, final tax bills can’t yet be calculated.