Community Government

Property values relatively unchanged after huge spike last year

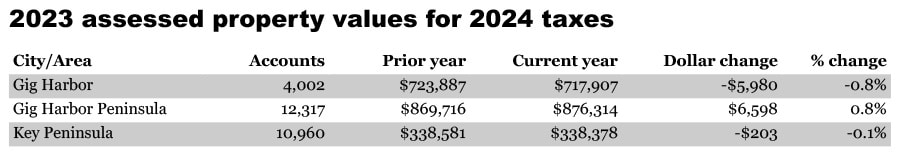

Gig Harbor-area property values stabilized this year after skyrocketing 24.5% in 2022. The green postcards en route to mailboxes will show just a 0.8% increase for the region overall and a 0.8% decrease within the city.

“Home values in all parts of our county have leveled off from the high-water mark of last year, and in most cases decreased slightly,” said Mike Lonergan, Pierce County Assessor-Treasurer.

The average Gig Harbor-area home value rose from $869,716 to $876,314. Within city limits, it slipped from $723,887 to $717,907. Key Peninsula values were practically unchanged, dropping 0.1%, from $338,581 to $338,378.

Countywide, the average single-family home decreased in value by 3.1%, from $572,100 to $554,500. Gig Harbor homes averaged the highest value. The town of Wilkeson had the lowest average value at $317,776.

Values used for next year’s taxes

All value changes represent the period from January 2022 to January 2023 and will be used to calculate 2024 taxes. Because voters could pass levies and bonds before the end of the year, final tax bills can’t yet be calculated. Tax statements will be mailed in February.

“Your property tax in 2024 will be the new 2023 value multiplied by the combined tax rates of your school district, city, fire district and other local districts, plus the statewide school levy that everyone pays,” Lonergan said. “So a lot depends on public votes such as levy lid lifts and bond issues.”

Levy lid lifts will have affect

This year, Gig Harbor Fire & Medic One and PenMet Parks both intend to ask voters to renew levy lid lifts that raise the limit on property tax collections from the 1% state limit to 6%. Their limits are already 6%, but their six-year terms are expiring so they want to extend them another six years.

Fire department funds would go toward day-to-day firefighting operations, such as vehicles, facilities and safety equipment. It would cost 32 cents per $1,000 of assessed property value, or about $280 more for the owner of an average-priced Gig Harbor-area home (worth $876,314).

PenMet’s levy lid lift would cost 17 cents per $1,000, or about $149 per year more for the average home.

Based on recent home sales

The assessor’s office each year must appraise all the county’s 325,000 taxable residential and business properties at 100 percent of their true and fair market value. That is defined as the price a willing buyer will pay a willing seller. The appraisal compares them to similar properties that have recently sold, adjusting for differences in age, condition, area and amenities, such as waterfront or view.

Once every six years, a county appraiser is required by state law to inspect every parcel in person, as they did at Tacoma houses this year. They confirm records, note any changes in condition of buildings and views, and take a new exterior photo. Major improvements will bump up the value.

Any property owner who believes the Assessor-Treasurer has over-valued their property can appeal to the Pierce County Board of Equalization at no cost. The appeal must be filed no later than Aug. 22, 2023, providing evidence that comparable properties have sold recently at a lower amount.

Higher interest rates cooled market

Michael Robinson of Windermere Professional Partners in Gig Harbor attributed the huge increase in property values last year to fear of imminent interest rate hikes, millennials joining the market and a surge in remote work. There was not enough housing to meet the demand.

On May 2, 2022, for example, there were 2.11 buyers for every house for sale, he said. The competition for a limited number of homes led to offers exceeding list price, cash purchases and waiving of home inspections. People rushed to buy a house at 4% interest regardless of whether they had to pay a higher price for it.

They were right about interest rates, which the Federal Reserve hiked to try to calm inflation brought on by the government stimulating the economy after the COVID pandemic.

Though demographics have remained unchanged, the higher rates have slowed sales, increased inventory and decelerated prices, which results in lower property values.

The Federal Reserve raised interest rates to cool the economy and lower inflation, dampening the hot housing market.

“Prices are limited right now by affordability because the rates are 6 ½ to 7%,” Robinson said. “It’s doing what the Feds hoped would happen and slowed down the market. The demand hasn’t gone away. The demographics and all the reasons to own a home are still there.”

It’ll heat up again

Robinson suggests gutting out the higher interest rates and buying now, because he believes rates will fall back to the 5s next year and ignite another hot housing market and higher property values.

“You marry the house but hold hands with the rate,” he said. “You can always refinance later. I really believe the market has got a lot of juice in it once we get into a more affordable rate.”

Lonergan said last year’s housing market cooling has continued so far in 2023.

“When interest rates went up, the total amount somebody could pay a month for a house leveled off. It took the pressure off, to a degree,” he said. “I don’t think we’ve seen the end of leveling off or decreasing. Already this year since January we’ve continued to see a drop off. People don’t have money burning a hold in their pockets. I think we’re going to see values go down again.”

Government collect taxes on a combination of residential and commercial properties, vacant land and personal property such as store equipment. Last year most commercial properties were slow to recover from COVID so there was a shift toward residential paying a larger share of the tax. Workers hadn’t returned to the office, resulting in vacancies, loss of building value and even conversion to living spaces.

With housing prices soaring and commercial values slumping last year, homeowners payed a larger share of property taxes. This year, most commercial properties showed moderate value increases over last year, with retail and office space up around 5% while motels and warehouses increased 10%, Lonergan said. That will allow them to shoulder a larger share of the tax burden this time around.